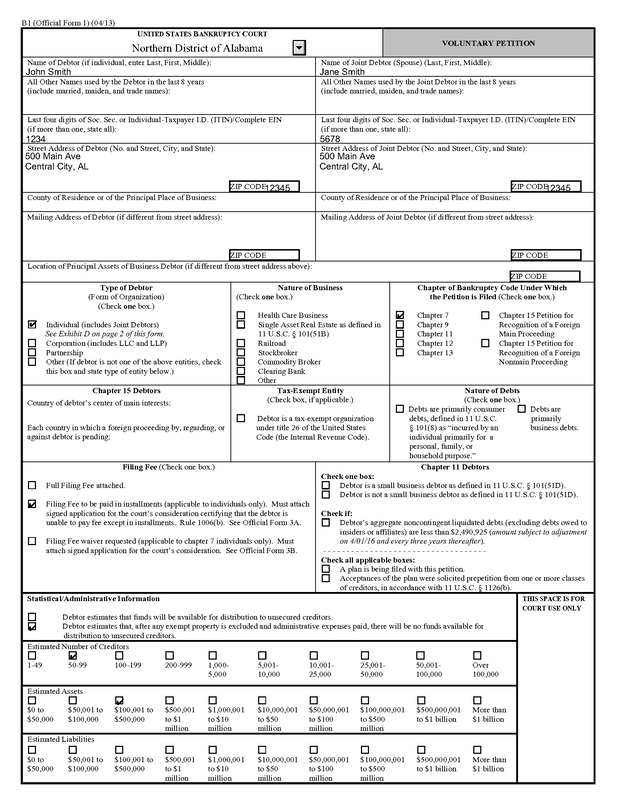

WHAT DOCUMENTS DO I NEED TO FILE BANKRUPTCY IN CULLMAN, ALABAMA?Consumer bankruptcy is a necessary process for those who have found themselves in financial difficulty and are having issues repaying their debt and need debt relief. Bankruptcies can occur as the result of job loss, natural disasters, medical expenses, or other life events. Regardless of the reason behind your bankruptcy filing, it is important to understand what documents are needed and why they are needed. At our office in Cullman County, Alabama, as your attorney we do not request you bring us these documents for our sake, but for yours. We would like to have as many of these documents at the time of your free consultation if possible. We wish filing for bankruptcy in Alabama was simpler, but it is not. The bankruptcy laws require us to answer an exhaustive amount of questions regarding your financial circumstances and to do so using due diligence, which means we cannot just take what you write down or provide us and put it in a form. We must take our own steps to try our best to be sure the information is complete and accurate. In order to declare an Alabama bankruptcy, an individual must file a document detailing their current financial status that typically runs at least 50 pages long. This is the case for either a Chapter 7 bankruptcy or a Chapter 13 bankruptcy. In order to complete this document your bankruptcy lawyer will need to have a lot of information regarding your financial situation; including, but not limited to your assets, debts, income, expenses, business information, and information over the past 2 to 4 years regarding sales or transfers of assets, inheritances, and current or past claims against others. We may not be able to get all of this information during your free consultation, and that is okay, but it is best to have as much of this bankruptcy information as possible.

Click here for a Free Consultation, no obligation and no pressure. Find out whether or not you should file for bankruptcy. Cullman Bankruptcy Attorney Questionnaire Your Cullman Bankruptcy Attorney will have a form for you to fill out once retained. We call it the Bankruptcy Questionnaire. Filling it out is much more efficient than telling your bankruptcy lawyer about all the details verbally and may be necessary if there are emergencies in between meetings with them. You should complete the form as thorough as possible. But, do not worry. The Bankruptcy Questionnaire is just the starting point of filing a bankruptcy for you. Your bankruptcy lawyer will not take that information and blindly fill out your petition. The bankruptcy attorney will review it, ask follow up questions, correct any mistakes, look for any possible issues that could arise, and, finally, the bankruptcy lawyer will go over the forms with you before you sign them to make sure you understand them and agree with them. Once we have the information needed and discuss your situation during your free consultation, we should be able to determine whether a Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for you. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman County, Alabama or by telephone if you prefer or are located elsewhere in Alabama. Find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Income Information and Verification Your Cullman Bankruptcy Attorney will need information and proof of your income to use for a couple of purposes. First, to file for bankruptcy the bankruptcy lawyer must complete a detailed current budget which sets out your current or projected income (if your income is about to change) and your current expenses other than those to be handled through your bankruptcy. If you are married and not separated, your bankruptcy lawyer must include your spouse’s income and expenses as well, even if he or she is not filing bankruptcy with you. If your spouse is not filing, his or her name will not be listed on the bankruptcy as filing, but their income and expenses must be shown as spouse’s income and spouse’s expenses. Proof of income requires paystubs, or if you do not receive paystubs, then another form of proof of income such as a printout from the employer, SSA benefits letter, or, in special circumstances, bank statements, or, if you have no income or proof of income, an affidavit swearing to that affect. The second reason the bankruptcy attorney needs your income information is that you’ll need to pass the Means Test for a Chapter 7 or determine your minimum payment if you file a Chapter 13. The Means Test compares your average income over the past 6 months to the average income of the same size family in Alabama. If your income is under that amount, it is a short form, and you can file either a Chapter 7 or Chapter 13. If your income exceeds a certain number, your bankruptcy lawyer must complete a longer form that allows certain deductions from your income. The majority of the time, this will bring your income down enough to qualify for a Chapter 7, but, if not, you may still file start the bankruptcy process. Even though you might not qualify for Chapter 7, we will use this information to determine the minimum plan payments for a Chapter 13. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman County, Alabama or by telephone if you prefer or are located elsewhere in North Alabama. Find out whether Chapter 7 bankruptcy or a Chapter 13 is right for your situation. Documents Needed for Your Cullman Bankruptcy: Personal Identification The bankruptcy court requires you to verify your identification. For a bankruptcy in Alabama we request a copy of your drivers license and social security card. If you have lost either of these or if your license has expired, now is the time to get replacements. We can use the temporary license you are provided when you seek a new license. In addition, the Social Security Office will give you a letter that can be used as a temporary Social Security Card when you request a replacement card. This temporary card can be used as well. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman, Alabama or by telephone if you prefer or are located elsewhere in North Alabama. Meet with our bankruptcy attorneys and find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Tax Returns The bankruptcy Trustees for bankruptcies filed near Cullman, Alabama; all of North Alabama, require us to send them a copy of your last 2 years federal tax returns if you were required to file. In addition, a requirement to qualify for bankruptcy is that you must have filed your last 4 years tax returns if you had income that required you to file. So, if you have not filed your tax returns, get them filed as soon as possible. You can owe the IRS or the State of Alabama taxes based on these returns, but the returns must be filed. Your case will be promptly dismissed if your returns are not filed. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman, Alabama or by telephone if you prefer or are located elsewhere in North Alabama. Meet with our bankruptcy attorneys and find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Bank Statements The bankruptcy Trustee for your Alabama bankruptcy case will require at least the most recent month of your bank statement. However, they can request more. Be sure to review the statement(s) to see if there have been any large withdrawals or unusual transactions and explain those to your bankruptcy attorney. If we do not provide an explanation for these transactions to the bankruptcy Trustee, they can raise suspicions. Remember: It's also imperative not to make any large purchases, payments, or transfers through your bank account or credit cards leading up to a bankruptcy proceeding as this can prompt the bankruptcy Trustee to attempt to recover these funds from the individuals or companies the funds were transferred to and cause many issues. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman, Alabama or by telephone if you prefer or are located elsewhere in North Alabama. Meet with our bankruptcy attorneys and find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Credit Counseling Certificate We, as your bankruptcy lawyers in Cullman, Alabama will require you obtain your pre-filing credit counseling certificate. This is a requirement of the bankruptcy law prior to filing your case. As your bankruptcy lawyers for your Cullman, AL bankruptcy we will assist you in obtaining this certificate. When you meet with one of our bankruptcy lawyers during your free consultation, the application to obtain the certificate will be reviewed with you. Once you complete it, we will add the necessary documentation and send it in to obtain the certificate for the bankruptcy court. Once you obtain the certificate, it is valid for up to 180 days. We, as your bankruptcy lawyers, will then file it with the bankruptcy court on your behalf when we file your bankruptcy case. For your Cullman, AL bankruptcy case in you will also need a post-filing personal financial management certificate. Again, we, as your bankruptcy lawyers in Cullman, AL, will assist you in obtaining this certificate. To obtain this certificate your bankruptcy lawyers will provide you with a DVD to watch and a short form to fill out while you are watching it. As your bankruptcy attorney in Cullman, AL, we will make the process as simple as possible. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman, Alabama or by telephone if you prefer or are located elsewhere in Alabama. Meet with our bankruptcy attorneys and find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Bills and Statements for All Debts When you file for bankruptcy you want to list all of your debts in order to obtain a fresh start. If you need to file, in order to start this bankruptcy process our law firm would like to have bills and statements for all of your debts. This includes debts for real estate or car loans that you would like to keep. You can almost always keep these debts, but we must disclose them to the court. We also want all credit card statements, bank loans, medical bills, collection letters, and any other documents you have received from a creditor. This is where bankruptcy can help you get debt relief and a fresh start. As your bankruptcy attorneys we will obtain your credit report from all three credit bureaus, but sometimes some debts do not show up on your credit report. A credit card will normally show up on your credit report; however, if the debt has been sold or sent for collections, that may not show on your credit report. Also, if you want a fresh start or debt relief from your doctor bills, our law firm would request you find as many of these bills as possible, because often these bills do not show up on your credit report. Documents Needed for Your Cullman Bankruptcy: Investment Account Statements Investment Accounts can be a tricky area in bankruptcy. If you have any type of pension or retirement account, these will most likely remain untouched and safe during the process. There is a federal exemption that applies to these accounts which protects them one hundred percent (100%). However this is not the same for non-retirement investment accounts. For other individually held accounts like stocks or bonds this is not always true so it's important to make your lawyer aware if you hold anything else outside of an IRA-type account with money invested into them. Documents Needed for Your Cullman Bankruptcy: Lawsuits, Judgments, and Garnishments If you have been sued by a credit card company, car loan company, or any other creditors, your attorney needs any paperwork you may have received. This includes the lawsuit itself, a judgment, if the court has already ruled on the case, and/or any garnishment papers if the creditor has filed those. Get Started Now - Get a Fresh Start - Get Debt Relief Click Above to Schedule Appointment and Complete the Questionnaire Online WHY WAIT? GET THE ANSWERS YOU NEED NOW WITH NO OBLIGATION OR STRINGS ATTACHED Serving Cullman, Hartselle, Decatur, Arab, Warrior, Gardendale, Hanceville, Priceville, Falkville, Jasper, Double Springs and the surrounding counties of Cullman, Morgan, Blount, Marshall, Jefferson, Walker, Winston, and Lawrence

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Details

AuthorI am an attorney located in Cullman, AL. I practice extensively in the area of consumer bankruptcy law, that is, I file Chapter 7 and Chapter 13 bankruptcies for individuals. I handle cases all over North Alabama and have helped hundreds of clients through the bankruptcy process., I receive many referrals from former clients and their families and other attorneys. Why? Unlike other firms, I have a local office. If you are from out of town, we have the technology available to keep your traveling to a minimum. Also, unlike many firms, you will meet personally with an attorney, not a paralegal. An attorney will handle your case from start to finish. , Archives

December 2021

Categories

All

|

RSS Feed

RSS Feed