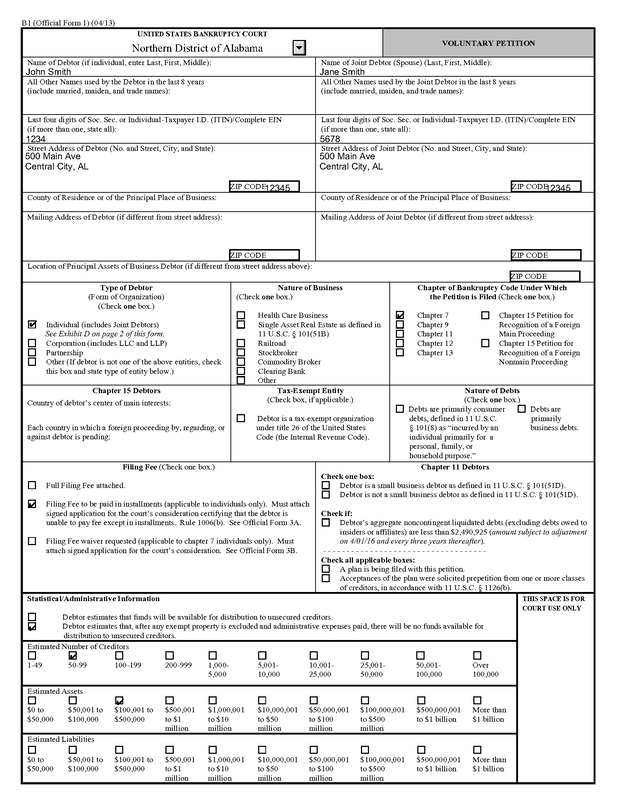

WHAT DOCUMENTS DO I NEED TO FILE BANKRUPTCY IN CULLMAN, ALABAMA?Consumer bankruptcy is a necessary process for those who have found themselves in financial difficulty and are having issues repaying their debt and need debt relief. Bankruptcies can occur as the result of job loss, natural disasters, medical expenses, or other life events. Regardless of the reason behind your bankruptcy filing, it is important to understand what documents are needed and why they are needed. At our office in Cullman County, Alabama, as your attorney we do not request you bring us these documents for our sake, but for yours. We would like to have as many of these documents at the time of your free consultation if possible. We wish filing for bankruptcy in Alabama was simpler, but it is not. The bankruptcy laws require us to answer an exhaustive amount of questions regarding your financial circumstances and to do so using due diligence, which means we cannot just take what you write down or provide us and put it in a form. We must take our own steps to try our best to be sure the information is complete and accurate. In order to declare an Alabama bankruptcy, an individual must file a document detailing their current financial status that typically runs at least 50 pages long. This is the case for either a Chapter 7 bankruptcy or a Chapter 13 bankruptcy. In order to complete this document your bankruptcy lawyer will need to have a lot of information regarding your financial situation; including, but not limited to your assets, debts, income, expenses, business information, and information over the past 2 to 4 years regarding sales or transfers of assets, inheritances, and current or past claims against others. We may not be able to get all of this information during your free consultation, and that is okay, but it is best to have as much of this bankruptcy information as possible.

Click here for a Free Consultation, no obligation and no pressure. Find out whether or not you should file for bankruptcy. Cullman Bankruptcy Attorney Questionnaire Your Cullman Bankruptcy Attorney will have a form for you to fill out once retained. We call it the Bankruptcy Questionnaire. Filling it out is much more efficient than telling your bankruptcy lawyer about all the details verbally and may be necessary if there are emergencies in between meetings with them. You should complete the form as thorough as possible. But, do not worry. The Bankruptcy Questionnaire is just the starting point of filing a bankruptcy for you. Your bankruptcy lawyer will not take that information and blindly fill out your petition. The bankruptcy attorney will review it, ask follow up questions, correct any mistakes, look for any possible issues that could arise, and, finally, the bankruptcy lawyer will go over the forms with you before you sign them to make sure you understand them and agree with them. Once we have the information needed and discuss your situation during your free consultation, we should be able to determine whether a Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for you. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman County, Alabama or by telephone if you prefer or are located elsewhere in Alabama. Find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Income Information and Verification Your Cullman Bankruptcy Attorney will need information and proof of your income to use for a couple of purposes. First, to file for bankruptcy the bankruptcy lawyer must complete a detailed current budget which sets out your current or projected income (if your income is about to change) and your current expenses other than those to be handled through your bankruptcy. If you are married and not separated, your bankruptcy lawyer must include your spouse’s income and expenses as well, even if he or she is not filing bankruptcy with you. If your spouse is not filing, his or her name will not be listed on the bankruptcy as filing, but their income and expenses must be shown as spouse’s income and spouse’s expenses. Proof of income requires paystubs, or if you do not receive paystubs, then another form of proof of income such as a printout from the employer, SSA benefits letter, or, in special circumstances, bank statements, or, if you have no income or proof of income, an affidavit swearing to that affect. The second reason the bankruptcy attorney needs your income information is that you’ll need to pass the Means Test for a Chapter 7 or determine your minimum payment if you file a Chapter 13. The Means Test compares your average income over the past 6 months to the average income of the same size family in Alabama. If your income is under that amount, it is a short form, and you can file either a Chapter 7 or Chapter 13. If your income exceeds a certain number, your bankruptcy lawyer must complete a longer form that allows certain deductions from your income. The majority of the time, this will bring your income down enough to qualify for a Chapter 7, but, if not, you may still file start the bankruptcy process. Even though you might not qualify for Chapter 7, we will use this information to determine the minimum plan payments for a Chapter 13. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman County, Alabama or by telephone if you prefer or are located elsewhere in North Alabama. Find out whether Chapter 7 bankruptcy or a Chapter 13 is right for your situation. Documents Needed for Your Cullman Bankruptcy: Personal Identification The bankruptcy court requires you to verify your identification. For a bankruptcy in Alabama we request a copy of your drivers license and social security card. If you have lost either of these or if your license has expired, now is the time to get replacements. We can use the temporary license you are provided when you seek a new license. In addition, the Social Security Office will give you a letter that can be used as a temporary Social Security Card when you request a replacement card. This temporary card can be used as well. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman, Alabama or by telephone if you prefer or are located elsewhere in North Alabama. Meet with our bankruptcy attorneys and find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Tax Returns The bankruptcy Trustees for bankruptcies filed near Cullman, Alabama; all of North Alabama, require us to send them a copy of your last 2 years federal tax returns if you were required to file. In addition, a requirement to qualify for bankruptcy is that you must have filed your last 4 years tax returns if you had income that required you to file. So, if you have not filed your tax returns, get them filed as soon as possible. You can owe the IRS or the State of Alabama taxes based on these returns, but the returns must be filed. Your case will be promptly dismissed if your returns are not filed. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman, Alabama or by telephone if you prefer or are located elsewhere in North Alabama. Meet with our bankruptcy attorneys and find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Bank Statements The bankruptcy Trustee for your Alabama bankruptcy case will require at least the most recent month of your bank statement. However, they can request more. Be sure to review the statement(s) to see if there have been any large withdrawals or unusual transactions and explain those to your bankruptcy attorney. If we do not provide an explanation for these transactions to the bankruptcy Trustee, they can raise suspicions. Remember: It's also imperative not to make any large purchases, payments, or transfers through your bank account or credit cards leading up to a bankruptcy proceeding as this can prompt the bankruptcy Trustee to attempt to recover these funds from the individuals or companies the funds were transferred to and cause many issues. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman, Alabama or by telephone if you prefer or are located elsewhere in North Alabama. Meet with our bankruptcy attorneys and find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Credit Counseling Certificate We, as your bankruptcy lawyers in Cullman, Alabama will require you obtain your pre-filing credit counseling certificate. This is a requirement of the bankruptcy law prior to filing your case. As your bankruptcy lawyers for your Cullman, AL bankruptcy we will assist you in obtaining this certificate. When you meet with one of our bankruptcy lawyers during your free consultation, the application to obtain the certificate will be reviewed with you. Once you complete it, we will add the necessary documentation and send it in to obtain the certificate for the bankruptcy court. Once you obtain the certificate, it is valid for up to 180 days. We, as your bankruptcy lawyers, will then file it with the bankruptcy court on your behalf when we file your bankruptcy case. For your Cullman, AL bankruptcy case in you will also need a post-filing personal financial management certificate. Again, we, as your bankruptcy lawyers in Cullman, AL, will assist you in obtaining this certificate. To obtain this certificate your bankruptcy lawyers will provide you with a DVD to watch and a short form to fill out while you are watching it. As your bankruptcy attorney in Cullman, AL, we will make the process as simple as possible. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman, Alabama or by telephone if you prefer or are located elsewhere in Alabama. Meet with our bankruptcy attorneys and find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Bills and Statements for All Debts When you file for bankruptcy you want to list all of your debts in order to obtain a fresh start. If you need to file, in order to start this bankruptcy process our law firm would like to have bills and statements for all of your debts. This includes debts for real estate or car loans that you would like to keep. You can almost always keep these debts, but we must disclose them to the court. We also want all credit card statements, bank loans, medical bills, collection letters, and any other documents you have received from a creditor. This is where bankruptcy can help you get debt relief and a fresh start. As your bankruptcy attorneys we will obtain your credit report from all three credit bureaus, but sometimes some debts do not show up on your credit report. A credit card will normally show up on your credit report; however, if the debt has been sold or sent for collections, that may not show on your credit report. Also, if you want a fresh start or debt relief from your doctor bills, our law firm would request you find as many of these bills as possible, because often these bills do not show up on your credit report. Documents Needed for Your Cullman Bankruptcy: Investment Account Statements Investment Accounts can be a tricky area in bankruptcy. If you have any type of pension or retirement account, these will most likely remain untouched and safe during the process. There is a federal exemption that applies to these accounts which protects them one hundred percent (100%). However this is not the same for non-retirement investment accounts. For other individually held accounts like stocks or bonds this is not always true so it's important to make your lawyer aware if you hold anything else outside of an IRA-type account with money invested into them. Documents Needed for Your Cullman Bankruptcy: Lawsuits, Judgments, and Garnishments If you have been sued by a credit card company, car loan company, or any other creditors, your attorney needs any paperwork you may have received. This includes the lawsuit itself, a judgment, if the court has already ruled on the case, and/or any garnishment papers if the creditor has filed those. Get Started Now - Get a Fresh Start - Get Debt Relief Click Above to Schedule Appointment and Complete the Questionnaire Online WHY WAIT? GET THE ANSWERS YOU NEED NOW WITH NO OBLIGATION OR STRINGS ATTACHED Serving Cullman, Hartselle, Decatur, Arab, Warrior, Gardendale, Hanceville, Priceville, Falkville, Jasper, Double Springs and the surrounding counties of Cullman, Morgan, Blount, Marshall, Jefferson, Walker, Winston, and Lawrence

0 Comments

Below I am linking an article by Amy Fontinelle with a good summary of what debt collectors are not supposed to be doing. If you are having these issues with a debt collector, you may have a Fair Debt Collection Practices Act violation case. You may also need to look into filing bankruptcy. Contact an attorney immediately. These types of cases can have short time limits on when you can file a case.

We offer free consultations for both FDCPA cases and bankruptcies. You have nothing to lose. Call (256)739-1962 or click here to contact us electronically. . . . . 5 Things Debt Collectors Are Forbidden To Do By Amy Fontinelle | Updated December 18, 2014 Debt collectors have a reputation – in some cases, a well-deserved one – for being obnoxious, rude and even scary when trying to get borrowers to pay up. The federal Fair Debt Collection Practices Act (FDCPA) is supposed to curb these annoying and abusive behaviors, but some debt collectors flout the law. Here’s what you should know about what debt collectors are forbidden from doing so you can stand up for yourself with confidence. Read more: 5 Things Debt Collectors Are Forbidden To Do Investopedia - http://www.investopedia.com/articles/personal-finance/121614/5-things-debt-collectors-are-forbidden-do.asp#ixzz40FYiQ0ja Yes. All collection attempts by creditors are to stop as soon as your bankruptcy is filed. When your bankruptcy is filed the "automatic stay" goes into place. This prohibits debt collectors from making any effort to collect any debt against you. It stops phone calls, letters, lawsuits, garnishments, foreclosures, and repossessions.

The automatic stay remains in effect during the pendency of your bankruptcy. It can be lifted by secured creditors to whom you are collateral to or to secured creditors to whom you were supposed to make payments to during the bankruptcy, but have not. Although the automatic stay goes into effect immediately when your bankruptcy is filed, in reality creditors will not receive notice from the bankruptcy court for 7 - 10 days. For this reason you or your attorney should inform creditors who are threatening to take actions such as foreclosure or garnishment that you have filed bankruptcy and provide the creditor with a case number. Creditors who knowingly violate the automatic stay will be required to reverse any adverse action they took after the automatic stay went into effect (such as foreclosure or repossession) and may be subject to paying fines and debtor's attorney's fees. If you are being harassed by collections efforts of creditors and debt collectors, contact me by clicking here or another qualified bankruptcy attorney in Alabama. The initial bankruptcy consultation is free. 3/5/2020 I am upside down on my car loan and am struggling to make the payment, but I really need my vehicle. Can an Alabama bankruptcy help me?Read NowPossibly. In a Chapter 13 bankruptcy you can, under certain circumstances, do what is called a cramdown. If you meet the criteria for a cramdown, you are allowed to only pay back the current fair market value of the vehicle, not the total amount owed.

For example, let’s assume you bought a car 2 ½ years ago, financed $25,000.00 and because your credit was not the best, you have a 12% interest rate. Your payments would be about $556.00 per month. You would still owe $14,352.00. Let’s say, per the NADA Used Car Guide you, the vehicle is now worth $8,000.00. By putting the vehicle in your Chapter 13 plan you could (1) extend the loan to 5 years, (2) reduce your interest rate tremendously (plan rates are currently at 5 to 5.25%, (3) in effect reduce your car payment to $152.00 (less than 1/3 the previous payment). So, what’s the catch? First, you must have had your car loan for at least 910 days, basically 2 ½ years in order to qualify for a cramdown. If you have not had your car for 910 days, you can still lower the interest rate, but not secured principal. Second, by extending the loan through the length of the plan, you may not be able to obtain the title on the vehicle until the end of the 5 year plan. Third, to maintain the benefit of the cramdown, you normally must complete your Chapter 13 plan. If your case is dismissed or you convert to a Chapter 7, some issues may arise. Fourth, your car must be worth less than the amount owed. If your car is worth the amount owed or more, then there is nothing to cramdown; however, you may still be able to lower the interest rate on the remaining amount owed on the loan. A Chapter 13 bankruptcy may be able to fix many of your cash flow problems. Please educate yourself and do not let yourself continue to struggle for no reason. Order my book by clicking here and/or contact me or another experienced bankruptcy lawyer immediately. 3/5/2020 I am being sued on a debt that the bank had previously charged off. Can they do that?Read NowIt is a common misconception that once a debt has been charged off by a creditor that the creditor can no longer collect on the debt and the debt just kind of goes away. Unfortunately, that is not the case.

A charge off is actually merely an accounting procedure by the creditor, whether it is a bank, credit card lender, mortgage company, auto loan company, or any other type of creditor. The creditor has at that point decided the account is no longer an asset to the company. Although the debt being charged off by the creditor is not a defense to having to pay the debt, there may be another defense. Whether the creditor or a collection company for the creditor can collect on the account depends on the statute of limitations. In Alabama the statute of limitations for most debts is either 3 years or 6 years, depending on the type of debt, from the last payment made on the debt. Be careful here, a payment of any type toward the debt could make a debt which has passed the statute of limitations or is about to pass the statute of limitations collectible again for another 3 or 6 years. Many times you may not hear anything about the debt for years, but out of the blue you are sued or begin receiving collection phone calls or letters regarding the debt. This often happens when a debt has been sold or transferred to different collection companies or debt buyers. If you have been sued on a charged off debt or are being harassed by a creditor or a collection company, a bankruptcy may be your best way to stop it. There may also be other ways to defend against the debt or settle the debt. Please educate yourself and do not let yourself be bullied by these companies. Order my book by clicking here and/or contact an experienced bankruptcy lawyer immediately. 3/5/2020 I have seen and heard lots of advertising by companies saying they can settle my debts for very little and help me avoid filing bankruptcy. Does this work?Read NowUnfortunately, debt settlement falls under the “if it sounds too good to be true, it is” category. While I am sure there may be a few success stories from people using these companies, I have yet to personally hear of one. Instead I have heard many complaints from clients who have wasted thousands of dollars on these “settlement” plans before having to turn to bankruptcy because of lawsuits and garnishments. Read the Federal Trade Commision's report on the subject here.

The problem is most people cannot afford to pay enough monthly to settle each credit card debt before at least one of the credit card companies file suit, obtains a judgment, and attempts garnishment. Also, if you can afford to save enough to do this, you could settle your credit card debt on your own without paying the high fees these debt settlement companies charge. Speaking of the fees, remember that even though these companies may call themselves “non-profit” and a few may technically qualify under the tax laws (this is apparently being questioned by the IRS), it does not mean they are a charity. These companies are clearly making lots of money. Why else would they be multiplying like rabbits and how else could they be buying all of that advertising? Many people think they are saving their credit by using these debt settlement companies. If your credit score has not already been significantly lowered before you use one of these companies, it will be by time you finish (which I have yet to see) or drop out. Settling for less than the amount owed is a negative on your credit report in itself. Add to that charge offs and judgments from the card companies that are not settled early and your credit score will show tremendous damage. A bankruptcy’s effect on your credit would be very similar and allow a quicker recovery. A bankruptcy may or may not be the answer for you, but do not buy the hype of these debt settlement companies and fall for their anti-bankruptcy propaganda. Do your research on these companies by checking with the Better Business Bureau and educate yourself about bankruptcy by getting your free copy of my The Alabama Bankruptcy Book by clicking here.

3/5/2020 Will a bankruptcy in Alabama stop a garnishment that is already being deducted from my paycheck?Read NowYES. I have been getting a lot of questions about garnishments lately. Both Chapter 7 and Chapter 13 bankruptcy filings in Alabama will stop garnishments. This is accomplished in a two step process. First, we must file your bankruptcy with the bankruptcy court and thereby obtain a case number for your bankruptcy.

Second, in the Court which issued the garnishment (normally your county’s Small Claims Court, District Court, or Circuit Court) we file a Motion to Quash Writ of Garnishment. In this motion we ask the Court that issued the garnishment to enter an order stopping the garnishment and to return to you any money the Court is holding or receives in the future from the garnishment. This means that if we can catch it in time, we may be able to get some of your money back. Having said this, I would strongly recommend filing a bankruptcy prior to a garnishment going into effect. I say this only because I know a garnishment taking 25% of your wages is not going to leave much to live on, much less enough to save to pay for a bankruptcy. Please note that a bankruptcy will not stop a garnishment or income withholding order related to child support. 3/5/2020 Do I qualify to file a Chapter 7 bankruptcy in Alabama under the “new” bankruptcy laws?Read NowMany people have been convinced that the bankruptcy reforms that went into effect in October of 2005 have made it impossible for most people to file Chapter 7 bankruptcies. Nothing could be further from the truth. Yes, there is now a “Means Test” which was intended to screen out people with “too much income.” But, in my experience almost everyone whom I have counseled with regarding filing a Chapter 7 bankruptcy who could have filed for Chapter 7 bankruptcy before the 2005 reforms still qualify to file a Chapter 7 bankruptcy in Alabama after the reforms. Nationwide studies have confirmed this -- Porter Study Finds Bankruptcy Law Reform Has Hurt the Poor Most and Bankruptcy Reform’s Impact: Where Are All the “Deadbeats”?

How does the “Means Test” work? First you see if you are over or under the median income for a family of your size in Alabama. For a quick check click here. If your household income is under the median income for the same size household in Alabama, then you have passed the “Means Test” and qualify to file a Chapter 7. If you are over the median income, it DOES NOT mean you are disqualified from filing a Chapter 7 bankruptcy. Most people can still file. There is just more paperwork to do. With the additional paperwork you are allowed to deduct taxes, housing costs, transportation costs, secured debt payments, medical costs, and many other costs. After deducting these costs, most people have very little income that could be used to pay unsecured creditors; and therefore, can file a Chapter 7 bankruptcy. The bottom line is, if you are having financial problems, do not let the “Means Test” scare you away from seeking good legal advice from a qualified bankruptcy attorney. The qualifications to file a Chapter 7 bankruptcy in Alabama are still fairly low. Despite anything you may have heard, there is a very high chance you can still file a Chapter 7 bankruptcy. And, if you are one of the few who cannot file a Chapter 7, you can probably file a Chapter 13 bankruptcy and still be protected from creditors. Filing for bankruptcy is a heart wrenching decision. On the one hand you want to do what you promised your creditors you would do, but on the other hand you have to house, feed, and clothe your family and yourself. There is no question that bankruptcy should be the last resort, but as to whether you should file or not, my classic lawyer answer is “It depends.”

First, we need to look at why you are considering filing bankruptcy. The most common reasons are the following:

If your answer to any of these questions is “Yes”, then it may be a good time to see an Alabama bankruptcy attorney. This does not necessarily mean you should file bankruptcy, but it does mean you may need some legal advice. The attorney may suggest some of the following alternatives to bankruptcy:

If any of these alternatives allow the possibility of a LONG TERM solution, then they should be greatly considered even though it may call for tough decisions and hard work. Why? Although bankruptcy can be a “quick fix”, it comes with some serious long term consequences to your financial future. The bottom line is I and many other Alabama bankruptcy attorneys offer free initial consultations, so it will not cost you anything to see what your options are. If after talking to an attorney, you think you can dig yourself out of the hole you are in without bankruptcy then definitely try that. But, if it does not work out you will be prepared and should have a plan. If you have further questions regarding this or other Alabama bankruptcy, debt, or budgeting questions please email me. 3/5/2020 What happens if I have a claim or lawsuit that I may get some money from in the future, but I need to file bankruptcy now?Read NowWhen “Jane” came to me about filing bankruptcy she was in dire straits. She had been sued by at least one creditor and was about to have her wages garnished. If her wages were garnished, the loss of 25% of her wages not have left her enough income to keep her mortgage and utilities paid and meet her other necessities.

Jane met all the qualifications to be able to file a Chapter 7 bankruptcy, but there was an issue. Jane’s father had died about one year earlier and his estate had a lawsuit against the nursing home where he died. A person having a claim of some type, but currently being in poor financial shape is fairly common. Often times an on the job injury (Worker’s Comp) or a car wreck (Personal Injury) results in a loss of income and an inability to pay debt. Jane had been told by the estate attorney that her father’s type of case, a wrongful death due to alleged malpractice by the nursing home, rarely settle and it could be years before the case went to trial. Even then there was no assurance they would win. So, what do you do? First, I explained to Jane that if she wanted to file bankruptcy, it is absolutely required that the lawsuit/claim be listed as an asset. This is very important and there has been a lot of litigation over this issue in the past few years. Lawsuits and estates are public records and are impossible to hide, do not try. Failing to list a claim or lawsuit on your bankruptcy petition may damage your chances of recovering any money from that lawsuit or claim. Second, I informed Jane that if and when she becomes entitled to any money from the lawsuit, the money would have to be paid to the bankruptcy trustee of her bankruptcy case and she may receive very little of the proceeds. The amount she would receive would depend on her remaining personal property exemption, the amount of the proceeds, and the amount of claims filed by creditors. With knowledge of the possible outcome, Jane decided she still needed to file bankruptcy immediately. Although Jane’s situation was different, it is normally required that the attorney representing the debtor in their lawsuit or claim file a motion with the bankruptcy court to be approved as the attorney and to have their fee contract approved as well. About a year after filing, her father’s wrongful death case settled. Jane’s share was about $20,000. What happened to the money? The $20,000 was paid by the estate’s attorney to the bankruptcy trustee. Jane still had $1,000 of her $3,000 personal property exemption available, so she was allowed the first $1,000. The trustee received a fee out of the proceeds, normally 10%. Then creditor claims were paid. In Jane’s case only $12,000 of creditor claims were filed which was much less than her debt at the time she filed. After all creditor’s claims were paid, Jane received the remainder. So, all in all Jane received about $6,000 from the settlement. I am sure Jane would have rather had the entire $20,000 share of the settlement, but her actual outcome really was not that bad. If she had had the $20,000 immediately before she filed, she would have had to have paid all or almost all of it to creditors. At least she was able to eat and pay her bills during the year before the case settled and was even able keep a good portion of the settlement after bankruptcy. Remember, this is not always the case. If all her creditors had filed claims, she would have only received the $1,000 exempt portion. If you are having financial difficulties, find out the truth about how bankruptcy may be able to help. Request my free book and/or call attorney Richard L. Collins or another experienced bankruptcy attorney. |

Details

AuthorI am an attorney located in Cullman, AL. I practice extensively in the area of consumer bankruptcy law, that is, I file Chapter 7 and Chapter 13 bankruptcies for individuals. I handle cases all over North Alabama and have helped hundreds of clients through the bankruptcy process., I receive many referrals from former clients and their families and other attorneys. Why? Unlike other firms, I have a local office. If you are from out of town, we have the technology available to keep your traveling to a minimum. Also, unlike many firms, you will meet personally with an attorney, not a paralegal. An attorney will handle your case from start to finish. , Archives

December 2021

Categories

All

|

RSS Feed

RSS Feed