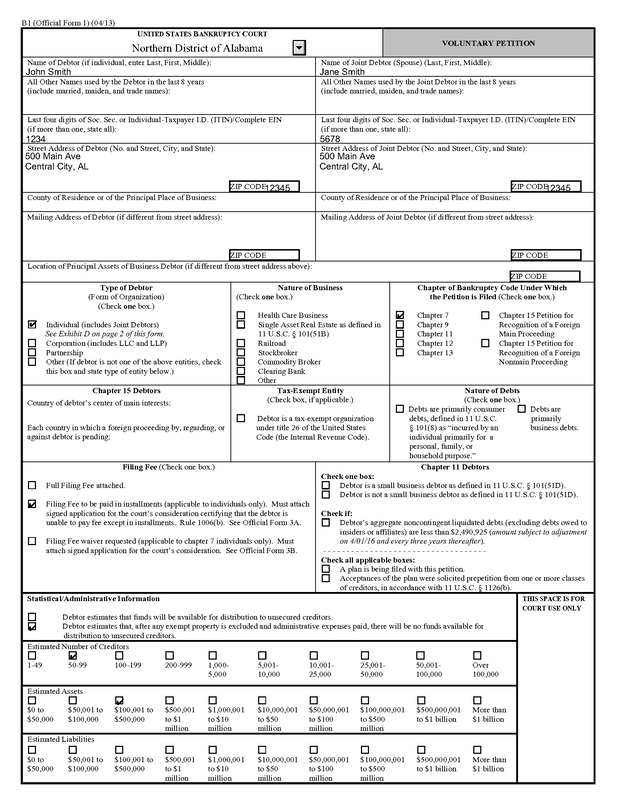

WHAT DOCUMENTS DO I NEED TO FILE BANKRUPTCY IN CULLMAN, ALABAMA?Consumer bankruptcy is a necessary process for those who have found themselves in financial difficulty and are having issues repaying their debt and need debt relief. Bankruptcies can occur as the result of job loss, natural disasters, medical expenses, or other life events. Regardless of the reason behind your bankruptcy filing, it is important to understand what documents are needed and why they are needed. At our office in Cullman County, Alabama, as your attorney we do not request you bring us these documents for our sake, but for yours. We would like to have as many of these documents at the time of your free consultation if possible. We wish filing for bankruptcy in Alabama was simpler, but it is not. The bankruptcy laws require us to answer an exhaustive amount of questions regarding your financial circumstances and to do so using due diligence, which means we cannot just take what you write down or provide us and put it in a form. We must take our own steps to try our best to be sure the information is complete and accurate. In order to declare an Alabama bankruptcy, an individual must file a document detailing their current financial status that typically runs at least 50 pages long. This is the case for either a Chapter 7 bankruptcy or a Chapter 13 bankruptcy. In order to complete this document your bankruptcy lawyer will need to have a lot of information regarding your financial situation; including, but not limited to your assets, debts, income, expenses, business information, and information over the past 2 to 4 years regarding sales or transfers of assets, inheritances, and current or past claims against others. We may not be able to get all of this information during your free consultation, and that is okay, but it is best to have as much of this bankruptcy information as possible.

Click here for a Free Consultation, no obligation and no pressure. Find out whether or not you should file for bankruptcy. Cullman Bankruptcy Attorney Questionnaire Your Cullman Bankruptcy Attorney will have a form for you to fill out once retained. We call it the Bankruptcy Questionnaire. Filling it out is much more efficient than telling your bankruptcy lawyer about all the details verbally and may be necessary if there are emergencies in between meetings with them. You should complete the form as thorough as possible. But, do not worry. The Bankruptcy Questionnaire is just the starting point of filing a bankruptcy for you. Your bankruptcy lawyer will not take that information and blindly fill out your petition. The bankruptcy attorney will review it, ask follow up questions, correct any mistakes, look for any possible issues that could arise, and, finally, the bankruptcy lawyer will go over the forms with you before you sign them to make sure you understand them and agree with them. Once we have the information needed and discuss your situation during your free consultation, we should be able to determine whether a Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for you. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman County, Alabama or by telephone if you prefer or are located elsewhere in Alabama. Find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Income Information and Verification Your Cullman Bankruptcy Attorney will need information and proof of your income to use for a couple of purposes. First, to file for bankruptcy the bankruptcy lawyer must complete a detailed current budget which sets out your current or projected income (if your income is about to change) and your current expenses other than those to be handled through your bankruptcy. If you are married and not separated, your bankruptcy lawyer must include your spouse’s income and expenses as well, even if he or she is not filing bankruptcy with you. If your spouse is not filing, his or her name will not be listed on the bankruptcy as filing, but their income and expenses must be shown as spouse’s income and spouse’s expenses. Proof of income requires paystubs, or if you do not receive paystubs, then another form of proof of income such as a printout from the employer, SSA benefits letter, or, in special circumstances, bank statements, or, if you have no income or proof of income, an affidavit swearing to that affect. The second reason the bankruptcy attorney needs your income information is that you’ll need to pass the Means Test for a Chapter 7 or determine your minimum payment if you file a Chapter 13. The Means Test compares your average income over the past 6 months to the average income of the same size family in Alabama. If your income is under that amount, it is a short form, and you can file either a Chapter 7 or Chapter 13. If your income exceeds a certain number, your bankruptcy lawyer must complete a longer form that allows certain deductions from your income. The majority of the time, this will bring your income down enough to qualify for a Chapter 7, but, if not, you may still file start the bankruptcy process. Even though you might not qualify for Chapter 7, we will use this information to determine the minimum plan payments for a Chapter 13. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman County, Alabama or by telephone if you prefer or are located elsewhere in North Alabama. Find out whether Chapter 7 bankruptcy or a Chapter 13 is right for your situation. Documents Needed for Your Cullman Bankruptcy: Personal Identification The bankruptcy court requires you to verify your identification. For a bankruptcy in Alabama we request a copy of your drivers license and social security card. If you have lost either of these or if your license has expired, now is the time to get replacements. We can use the temporary license you are provided when you seek a new license. In addition, the Social Security Office will give you a letter that can be used as a temporary Social Security Card when you request a replacement card. This temporary card can be used as well. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman, Alabama or by telephone if you prefer or are located elsewhere in North Alabama. Meet with our bankruptcy attorneys and find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Tax Returns The bankruptcy Trustees for bankruptcies filed near Cullman, Alabama; all of North Alabama, require us to send them a copy of your last 2 years federal tax returns if you were required to file. In addition, a requirement to qualify for bankruptcy is that you must have filed your last 4 years tax returns if you had income that required you to file. So, if you have not filed your tax returns, get them filed as soon as possible. You can owe the IRS or the State of Alabama taxes based on these returns, but the returns must be filed. Your case will be promptly dismissed if your returns are not filed. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman, Alabama or by telephone if you prefer or are located elsewhere in North Alabama. Meet with our bankruptcy attorneys and find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Bank Statements The bankruptcy Trustee for your Alabama bankruptcy case will require at least the most recent month of your bank statement. However, they can request more. Be sure to review the statement(s) to see if there have been any large withdrawals or unusual transactions and explain those to your bankruptcy attorney. If we do not provide an explanation for these transactions to the bankruptcy Trustee, they can raise suspicions. Remember: It's also imperative not to make any large purchases, payments, or transfers through your bank account or credit cards leading up to a bankruptcy proceeding as this can prompt the bankruptcy Trustee to attempt to recover these funds from the individuals or companies the funds were transferred to and cause many issues. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman, Alabama or by telephone if you prefer or are located elsewhere in North Alabama. Meet with our bankruptcy attorneys and find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Credit Counseling Certificate We, as your bankruptcy lawyers in Cullman, Alabama will require you obtain your pre-filing credit counseling certificate. This is a requirement of the bankruptcy law prior to filing your case. As your bankruptcy lawyers for your Cullman, AL bankruptcy we will assist you in obtaining this certificate. When you meet with one of our bankruptcy lawyers during your free consultation, the application to obtain the certificate will be reviewed with you. Once you complete it, we will add the necessary documentation and send it in to obtain the certificate for the bankruptcy court. Once you obtain the certificate, it is valid for up to 180 days. We, as your bankruptcy lawyers, will then file it with the bankruptcy court on your behalf when we file your bankruptcy case. For your Cullman, AL bankruptcy case in you will also need a post-filing personal financial management certificate. Again, we, as your bankruptcy lawyers in Cullman, AL, will assist you in obtaining this certificate. To obtain this certificate your bankruptcy lawyers will provide you with a DVD to watch and a short form to fill out while you are watching it. As your bankruptcy attorney in Cullman, AL, we will make the process as simple as possible. Click here for a Free Consultation, no obligation and no pressure. Your consultation can be in person if you are near Cullman, Alabama or by telephone if you prefer or are located elsewhere in Alabama. Meet with our bankruptcy attorneys and find out whether Chapter 7 bankruptcy or a Chapter 13 bankruptcy is right for your situation. Documents Needed for Your Cullman Bankruptcy: Bills and Statements for All Debts When you file for bankruptcy you want to list all of your debts in order to obtain a fresh start. If you need to file, in order to start this bankruptcy process our law firm would like to have bills and statements for all of your debts. This includes debts for real estate or car loans that you would like to keep. You can almost always keep these debts, but we must disclose them to the court. We also want all credit card statements, bank loans, medical bills, collection letters, and any other documents you have received from a creditor. This is where bankruptcy can help you get debt relief and a fresh start. As your bankruptcy attorneys we will obtain your credit report from all three credit bureaus, but sometimes some debts do not show up on your credit report. A credit card will normally show up on your credit report; however, if the debt has been sold or sent for collections, that may not show on your credit report. Also, if you want a fresh start or debt relief from your doctor bills, our law firm would request you find as many of these bills as possible, because often these bills do not show up on your credit report. Documents Needed for Your Cullman Bankruptcy: Investment Account Statements Investment Accounts can be a tricky area in bankruptcy. If you have any type of pension or retirement account, these will most likely remain untouched and safe during the process. There is a federal exemption that applies to these accounts which protects them one hundred percent (100%). However this is not the same for non-retirement investment accounts. For other individually held accounts like stocks or bonds this is not always true so it's important to make your lawyer aware if you hold anything else outside of an IRA-type account with money invested into them. Documents Needed for Your Cullman Bankruptcy: Lawsuits, Judgments, and Garnishments If you have been sued by a credit card company, car loan company, or any other creditors, your attorney needs any paperwork you may have received. This includes the lawsuit itself, a judgment, if the court has already ruled on the case, and/or any garnishment papers if the creditor has filed those. Get Started Now - Get a Fresh Start - Get Debt Relief Click Above to Schedule Appointment and Complete the Questionnaire Online WHY WAIT? GET THE ANSWERS YOU NEED NOW WITH NO OBLIGATION OR STRINGS ATTACHED Serving Cullman, Hartselle, Decatur, Arab, Warrior, Gardendale, Hanceville, Priceville, Falkville, Jasper, Double Springs and the surrounding counties of Cullman, Morgan, Blount, Marshall, Jefferson, Walker, Winston, and Lawrence

0 Comments

The processes, theories, and inner workings of a Chapter 13 Bankruptcy can sometimes be hard to explain. Recently, the United States Court of Appeals for the Eleventh Circuit, which covers Alabama, Georgia, and Florida, released an opinion in In Re: Paul L. Cumbess, Debtor; Microf LLC vs. Paul L. Cumbess, et al, Case No. 19-12088; which gave a really good explanation of the overall Chapter 13 Bankruptcy process.

As you will see from the opinion below, Chapter 13 Bankruptcy’s, even when explained as straight forward as possible, can be complicated. This is why you should see a qualified bankruptcy attorney. At Collins Law Offices, your Cullman Bankruptcy Attorney, we offer Free In-Depth No Obligation Consultations. We will answer any questions you may have and provide you with the best options possible, whether it is Chapter 13 or Chapter 7 Bankruptcy or debt settlement or debt defense. And, we will do so with No Strings Attached. We will not add any more pressure to your life. Here is the pertinent part of the 11th Circuit’s opinion: Before we dive into the details of this case, a bit of Chapter 13 background is in order. First, let’s talk mechanics. A Chapter 13 bankruptcy—sometimes called a “wage earners plan”—enables a debtor with a regular income to repay all or part of his debts, typically over a three- to five-year period. After the debtor initiates a Chapter 13 case by filing a petition, he must then—within 14 days—file a proposed plan of reorganization, which provides that he will make certain fixed payments over time. The bankruptcy court then determines whether the proposed plan conforms to the Bankruptcy Code. If it does, the court confirms the plan, which then becomes binding on the debtor, the creditors, and the Chapter 13 trustee, whose job it is to assist with the plan’s administration. In a Chapter 13 proceeding, the bankruptcy estate—the pool of property from which the debtor’s creditors are paid—comprises all of the debtor’s legal and equitable interests in property at the time of the filing of the case, as well as those that he acquires after the filing. See 11 U.S.C. §§ 541, 1306(a). Unlike in a Chapter 7 “liquidation” proceeding, however, a Chapter 13 debtor can maintain possession of some or all of his assets throughout the bankruptcy; the debtor’s plan payments (and thus the payments to his creditors) typically come from his future earnings. Generally speaking, there are two types of claims in a Chapter 13 case: secured and unsecured. Importantly for our purposes, the Bankruptcy Code treats different kinds of unsecured claims, well, differently. A typical unsecured claim— also called a “general unsecured claim”—needn’t be paid in full. The Code requires only that creditors holding general unsecured claims receive what they would under a Chapter 7 liquidation. 11 U.S.C. § 1325(a)(4). The Code also provides, though, that some unsecured claims are entitled to “priority,” such that they have to be paid in full unless the creditor agrees otherwise. 11 U.S.C. § 1322(a)(2). Examples of claims entitled to priority include domestic-support obligations, certain taxes, and—as particularly relevant here—“administrative expenses” associated with the proceeding, including the “actual, necessary costs and expenses of preserving the estate.” 11 U.S.C. §§ 503(b)(1)(A), 507. Now, the players. First, of course, there’s the debtor—he initiates the Chapter 13 proceeding, proposes the reorganization plan, and (if all goes well) makes payments in accordance with it. Within the Chapter 13 process, the debtor’s objective is to “obtain court approval . . . of a plan that provides for the payment of as little as possible to creditors and to emerge at the end of the process with as much property and as little debt as possible.” Hon. W. Homer Drake, Jr., et al., Chapter 13 Practice and Procedure § 1:1 (2019). Then, there are the creditors—the people or entities who have claims against the debtor. Predictably, the creditors’ incentives run counter to the debtor’s: Their aim is to “maximize their recoveries by having the debtor pay as much as possible.” Id. Finally, there’s the trustee, who is appointed by the bankruptcy court after the debtor files a Chapter 13 petition to assist with the case’s administration. The Chapter 13 trustee is a “representative of the bankruptcy estate,” id. at § 17:1, and her “primary purpose . . . is . . . to serve the interests of all the creditors,” Hope v. Acorn Fin., Inc., 731 F.3d 1189, 1193 (11th Cir. 2013). Although a Chapter 13 trustee has many statutory rights and responsibilities, see 11 U.S.C. § 1302(b), she plays a particularly important role in connection with the debtor’s plan: She must appear and be heard at any hearing regarding plan confirmation or modification, advise and assist the debtor in his performance under the plan, ensure that the debtor makes timely payments under the plan, and disburse those payments to creditors in accordance with the plan. See Drake, et al., supra, at § 17:3. There’s one last piece of introductory ground we need to cover: executory contracts. At the time a debtor files a Chapter 13 petition, he may be subject to the ongoing benefits and burdens of an unexpired executory contract—such as, in this case, a lease. When this happens, the debtor has three choices going forward: he can “assume” the contract (i.e., commit to performing its obligations), “reject” the contract (i.e., commit to breaching its obligations), or “assign” the contract (i.e., provide that a third party will perform its obligations). 11 U.S.C. § 1322(b). Less clear, however—and the issue at the center of this appeal—is the effect that the debtor’s assumption-rejection-assignment election has on the bankruptcy estate and whether, for instance, the debtor’s decision to assume a lease obligates the bankruptcy estate independent of any action by the Chapter 13 trustee. (for the full text of the opinion click HERE) Chapter 13 Bankruptcies and Bankruptcy in general is a complex area of the law; however, with the right bankruptcy lawyer it can be an excellent tool to solve your financial problems. This is why it would benefit you to consult with a qualified bankruptcy attorney instead of continuing to worry about the situation. At Collins Law Offices we offer Free In-Depth No Obligation Consultations with a bankruptcy attorney that are designed for just this reason. We can help you stop worrying, because you will have a plan and the support of an expert bankruptcy lawyer to get you back on your feet. We have years of experience working in bankruptcy and will be at your disposal should questions arise during your bankruptcy -- our goal is to provide peace of mind while also providing expert advice on what course of action may work best for your situation. If you are having problems with debt, there is no reason not to at least learn about possible solutions that are out there even if you are not ready to take that step at this time. There will not be any added pressure or obligation placed on you, only relief and understanding. For a Free In-Depth No Obligation Consultation click here.

3/5/2020 Do I qualify to file a Chapter 7 bankruptcy in Alabama under the “new” bankruptcy laws?Read NowMany people have been convinced that the bankruptcy reforms that went into effect in October of 2005 have made it impossible for most people to file Chapter 7 bankruptcies. Nothing could be further from the truth. Yes, there is now a “Means Test” which was intended to screen out people with “too much income.” But, in my experience almost everyone whom I have counseled with regarding filing a Chapter 7 bankruptcy who could have filed for Chapter 7 bankruptcy before the 2005 reforms still qualify to file a Chapter 7 bankruptcy in Alabama after the reforms. Nationwide studies have confirmed this -- Porter Study Finds Bankruptcy Law Reform Has Hurt the Poor Most and Bankruptcy Reform’s Impact: Where Are All the “Deadbeats”?

How does the “Means Test” work? First you see if you are over or under the median income for a family of your size in Alabama. For a quick check click here. If your household income is under the median income for the same size household in Alabama, then you have passed the “Means Test” and qualify to file a Chapter 7. If you are over the median income, it DOES NOT mean you are disqualified from filing a Chapter 7 bankruptcy. Most people can still file. There is just more paperwork to do. With the additional paperwork you are allowed to deduct taxes, housing costs, transportation costs, secured debt payments, medical costs, and many other costs. After deducting these costs, most people have very little income that could be used to pay unsecured creditors; and therefore, can file a Chapter 7 bankruptcy. The bottom line is, if you are having financial problems, do not let the “Means Test” scare you away from seeking good legal advice from a qualified bankruptcy attorney. The qualifications to file a Chapter 7 bankruptcy in Alabama are still fairly low. Despite anything you may have heard, there is a very high chance you can still file a Chapter 7 bankruptcy. And, if you are one of the few who cannot file a Chapter 7, you can probably file a Chapter 13 bankruptcy and still be protected from creditors. Filing for bankruptcy is a heart wrenching decision. On the one hand you want to do what you promised your creditors you would do, but on the other hand you have to house, feed, and clothe your family and yourself. There is no question that bankruptcy should be the last resort, but as to whether you should file or not, my classic lawyer answer is “It depends.”

First, we need to look at why you are considering filing bankruptcy. The most common reasons are the following:

If your answer to any of these questions is “Yes”, then it may be a good time to see an Alabama bankruptcy attorney. This does not necessarily mean you should file bankruptcy, but it does mean you may need some legal advice. The attorney may suggest some of the following alternatives to bankruptcy:

If any of these alternatives allow the possibility of a LONG TERM solution, then they should be greatly considered even though it may call for tough decisions and hard work. Why? Although bankruptcy can be a “quick fix”, it comes with some serious long term consequences to your financial future. The bottom line is I and many other Alabama bankruptcy attorneys offer free initial consultations, so it will not cost you anything to see what your options are. If after talking to an attorney, you think you can dig yourself out of the hole you are in without bankruptcy then definitely try that. But, if it does not work out you will be prepared and should have a plan. If you have further questions regarding this or other Alabama bankruptcy, debt, or budgeting questions please email me. |

Details

AuthorI am an attorney located in Cullman, AL. I practice extensively in the area of consumer bankruptcy law, that is, I file Chapter 7 and Chapter 13 bankruptcies for individuals. I handle cases all over North Alabama and have helped hundreds of clients through the bankruptcy process., I receive many referrals from former clients and their families and other attorneys. Why? Unlike other firms, I have a local office. If you are from out of town, we have the technology available to keep your traveling to a minimum. Also, unlike many firms, you will meet personally with an attorney, not a paralegal. An attorney will handle your case from start to finish. , Archives

December 2021

Categories

All

|

RSS Feed

RSS Feed